DCCU Routing # 251483311

In This Issue

Member Matters is DCCU's quarterly newsletter that features credit union news, member stories, and more!

How You Can Prepare for Rising Interest Rates

In recent weeks, you may have noticed interest rates starting to rise. DCCU is here to help you navigate the cycles. I encourage you to reach out to us with any questions you may have.

Building a Deeper Relationship with DCCU

Dr. Hull initially engaged with DCCU to make smart business decisions for his practice, and over the years that relationship has deepened through partnerships to support the financial wellness of his staff.

A New DCCU Location is Coming Soon

We are pleased to share some exciting news about our cooperative. Later this year, we will open our 14th branch location in Fishersville!

2021 Chairman’s Report

DuPont Community Credit Union (DCCU) experienced another positive year in 2021. Even in the midst of a pandemic, we demonstrated our continued commitment to the membership and our community.

2022 Board of Directors Election Results Announced

Congratulations to Angela M. Simonetti, Michael P. Blinn, Janet P. Mangun, and David A. Kirby on their election to DCCU’s Board of Directors, as announced at DCCU’s Virtual Annual Meeting on March 29, 2022.

Free Social Security Workshop

DuPont Community Credit Union invites you to attend a free workshop given by Member Investment Services on options to better position your Social Security Benefits.

Employee Spotlight

20 Years of Service

Denna Baraclough

15 Years of Service

Jessica Bartley

Patricia Benson

Faith Caricofe

Heather Farrar

Stephanie Gaines

Jacob Larew

Khen Quach

Katie Roby

10 Years of Service

Ashley Alexander

Sonya Crider

5 Years of Service

Gordon Delaney

Courtney McCormick

Promotions

Jessica Bartley – ATM Administrator

Courtney Bean – Lead Credit Underwriter

Breanna Coleman – Solutions Officer

Ashley Stevens – Member Advisor, Service Center

Brandy Withrow – Helpdesk Technician

Fallon Wright – Assistant Service Center Manager

In recent weeks, you may have noticed interest rates starting to rise. After years of borrowers enjoying historically low interest rates, the Federal Reserve is starting to adjust its monetary policy and those types of changes affect the financial system.

The Federal Reserve influences the supply of money available in the United States. To stimulate the economy, it can increase the supply of money in circulation by lowering interest rates, for example, as they did to help relieve some consumer financial burden at the onset of the pandemic. Alternately, when the Fed wants to slow down the economy, it attempts to reduce the supply of money in circulation by raising interest rates to make debt a little less appealing. Because inflation is high, the labor market is strong, and the economy is no longer in crisis, the Fed has indicated that a move in this direction is in order.

Rising interest rates can impact your finances, especially when it comes to products with variable rates. This includes adjustable rate mortgages, credit cards, and savings, for example. When interest rates rise, borrowing money becomes more expensive. There are, however, a few points worth considering as you think about your budget and financial goals.

Consider paying down your debt

If you hold variable rate debt and have the budget capacity, now would be a great time to pay it down. Debt consolidation is another option for simplifying your finances and can help you pay down your debt faster.

Evaluate upcoming purchases

If you are planning to take out a loan soon, keep in mind the interest rate you receive today may be higher in the coming months. If the purchase fits your budget and you are financially ready, it may be beneficial to go ahead and make that purchase sooner rather than later.

Keep a balanced perspective

Although there is the potential for rates to begin increasing, it’s important not to panic. Just be sure to give thought to how a rising interest rate scenario can impact your current finances. It is a good practice to keep a balanced perspective on both the current and potential future interest rate environments.

The bottom line is – DCCU is here to help. Our goal is to help improve your financial health. We have a variety of products that can fit your financial needs, including fixed rate mortgages, Home Equity Plus, which is a line of credit that easily converts to a fixed rate loan, and many other options that can support you through interest rate uncertainty. Whether rates are rising or falling, our team of dedicated financial professionals want to help you navigate the cycles. I encourage you to reach out to us with any questions you may have and we will gladly assist. As always, I appreciate your continued support of our cooperative.

Dr. Robert Hull is a native of Lexington, Virginia. After obtaining his D.D.S. from Case Western Reserve University School of Dental Medicine in Cleveland, Ohio, he returned to his hometown and worked at his father’s dental practice before starting his own practice in 2006. “I came back home because I love this area,” Hull said. “I am happy to be a part of the lives of the people in this community – whether they have been here for generations or transplanted here to escape the city life.” Over the years, Dr. Hull has worked to fulfill his vision of providing quality dentistry as comfortably as possible through the use of modern techniques and technology. “Being in a small town isn’t always easy when it comes to specialty services,” Hull said. “People often have to travel quite a bit to see a specialist, so we try to minimize that need for patients.”

DCCU opened its Lexington Member Center in 2015. At the time, Dr. Hull was looking to refinance his current office space in the Magnolia Square office complex. Recognizing the importance of having a strong financial partner to support his growing practice, he did his due diligence by researching local financial institutions. “DCCU was new to the area at the time and they ultimately had the best rates compared to any other financial institution,” Hull said. “That’s how my relationship with DCCU began and it has been a very positive experience ever since.”

Beyond rates, Dr. Hull lauds the personalized service he receives from DCCU. “Competitive rates are important, but it’s service that sets the foundation for relationship,” Hull said. “If I need anything, DCCU is eager to respond. They go out of their way to make sure I am in the best place to succeed. It makes a big difference.” Since starting his relationship with DCCU, that same level of service has been extended to his staff, who have also benefited from establishing a relationship with DCCU, whether through auto loans, home loans, home equity loans, or other financial products.

In order to help financially empower his staff, Dr. Hull has also engaged with DCCU’s Community and Business Development team. They offer a workplace financial education program called DCCU at Work that provides free financial wellness training for local employers on a variety of topics such as building credit, developing a budget, investing for the future, and more. The program offers on-site training sessions as well as online resources that help participants manage their finances better, which ultimately helps reduce stress and sets them on a path to financial wellness. The sessions are customizable and built to suit the needs of the group. “We have a family relationship among our staff, and I want them to be successful,” Hull said. “My employees look forward to the DCCU at Work financial wellness workshops. DCCU takes complex topics and presents the information in a fun and non-intimidating way. These sessions have helped my staff learn how to make small steps to improve their financial awareness. I want to help them achieve their dreams and goals – and DCCU at Work has been a big help.”

Community involvement is another area where Dr. Hull and DCCU align. DCCU is a community credit union, active in the communities we serve through sponsorships, donations, and volunteerism. Dr. Hull has been the head coach for Rockbridge County High School’s Boys Lacrosse team for the last four years. “Because lacrosse is not a mainstream sport in this area like basketball, football, or baseball, we have no annual budget and have to fundraise to support the program,” Hull said. “We have to do more with less and try to help lower the threshold for these kids who may have trouble affording uniforms or equipment. I am appreciative of the relationships between DCCU and other local organizations that offer steady support so that we can maintain a successful program.”

At DCCU, our focus is on helping to improve the financial wellness of our members and the communities we serve. In addition to offering competitive rates on our products, DCCU provides personalized service and financial education programs, all while supporting local organizations and programs that help make our community a better place. Dr. Hull initially engaged with DCCU to make smart business decisions for his practice, and over the years that relationship has deepened through partnerships to support the financial wellness of his staff and sponsorship of the local lacrosse team he coaches. “Because we share a dedication to areas that are important to us both, it made deepening the relationship with DCCU easier,” Hull said. “I relish the relationship I have with DCCU. I am very happy that you came into this area to afford us another viable banking option to help advance our close-knit community.”

2021 Chairman's Report

DuPont Community Credit Union (DCCU) experienced another positive year in 2021. Even in the midst of a pandemic, we demonstrated our continued commitment to the membership and our community.

Highlights from 2021:

- We funded $214.2 Million in real estate loans in 2021, helping 1,159 members purchase or refinance their homes. We remain committed to supporting the mortgage needs of our members and becoming the premier real estate lender in the Shenandoah Valley.

- Additionally, we served 9,792 members as we funded $129.2 Million in auto (5,041), credit card (3,972), and home equity loans (779); and $49.2 Million in member business loans (407).

- The Paycheck Protection Program (PPP) continued into 2021 with a second round of funding and an emphasis on helping business members request and obtain loan forgiveness. In 2021, DCCU made 305 loans totaling $8.3 Million during the second round of funding. Additionally, 608 PPP borrowers had their loans forgiven in 2021.

- DCCU donated $44,408 to local Habitat for Humanity affiliates. Various campaigns and fundraisers were held throughout the year to provide this donation, including our Corporate Charity, Make a Difference when you DIY credit card campaign, and our DCCU Cares Virtual 5K/10K for employees.

- DCCU had another strong year supporting the Blue Ridge Area Food Bank in 2021. During our Spring and Fall Shred Days, we shredded documents from our members and the community while collecting food and monetary donations. We shredded over 89,520 pounds of sensitive documents, collected 8,564 pounds of food, and received $6,685 in monetary donations. Additionally, employees collected $6,970 in donations as part of our Corporate Charity campaign. Through food and monetary donations, we helped the food bank provide approximately 61,595 meals for families in need.

- DCCU launched a new Online Banking platform that helps make banking even more convenient by offering a personalized interaction that complements the consultative service our members receive from our branches and Service Center.

- The Virginia Credit Union League selected DCCU as the winner of the 2021 Louise Herring Philosophy In Action Award in the over $1 Billion asset size category. We received first place for our Dine Out and Make a Difference campaign, which supported local restaurants and the Blue Ridge Area Food Bank at a time when restaurants were severely impacted by the pandemic and food insecurity was on the rise. Our first place entry went on to be considered for the Credit Union National Association’s National Award, where we placed second in the nation.

- For the third year in a row, DCCU was ranked as the top Virginia credit union according to Forbes, who partnered with research firm Statista for their annual look at the Best Credit Unions in each State.

These highlights reflect some of the ways we deliver value to our members and help make a difference in our community. We are encouraged about 2022 and excited for the many years ahead. On behalf of the Board of Directors and the staff of DuPont Community Credit Union, we appreciate your membership and continued support of our financial cooperative.

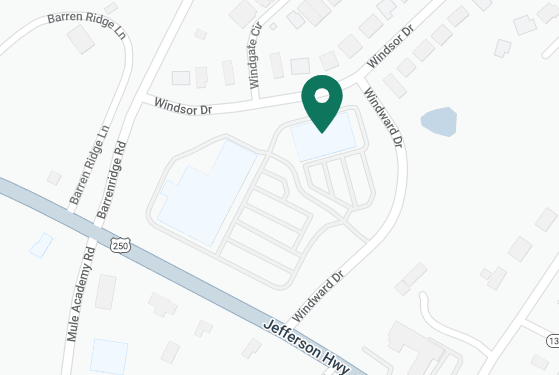

A New DCCU Location is Coming Soon

DCCU remains committed to delivering personalized, consultative banking experiences for our growing membership, and we are pleased to share some exciting news about our cooperative. Later this year, we will open our 14th branch location in Fishersville!

Our Windward Pointe Member Center will be conveniently located in the Food Lion shopping center in Fishersville, adjacent to the Windward Pointe community. Many members want to come into a branch for personalized assistance while some prefer to do their day-to-day banking using our digital channels. This branch will offer the best of both and represents DCCU’s continued commitment to serving the needs of our evolving membership.

Some notable features include:

- A full-service Member Center with a dedicated team to assist with your banking needs

- Mortgage, Business, and Investment Advisors on-site

- Interactive Teller Machines that operate like a traditional ATM with additional video capabilities

We are planning to open our Windward Pointe Member Center late summer. Additional information will be shared in the coming months as the timeline is finalized.

2022 Board of Directors Election Results Announced

Congratulations to Angela M. Simonetti, Michael P. Blinn, and Janet P. Mangun on their election to DCCU’s Board of Directors, as announced at DCCU’s Virtual Annual Meeting on March 29, 2022. Each will serve a three-year term. Additionally, as the fourth highest vote getter, David A. Kirby will serve a one-year term as he completes the remainder of former Director Maurice Gresham’s term.

Angela M. Simonetti

Janet P. Mangun

Michael P. Blinn

David A. Kirby

Two new member volunteers began their one-year terms in April: Christopher Terry, Associate Director and Marissa Helmick, Associate Supervisory Committee Member.

Each year, the Governance Committee is tasked with seeking member volunteers for open positions on the DCCU Board of Directors, Supervisory Committee, and Governance Committee. Nominations will be accepted June 1, 2022 through June 30, 2022 for positions opening in 2023.

There will be two three-year terms expiring on the Board in 2023 for Drew E. Gogian and David A. Kirby. Details about volunteer openings and the nomination process will be available at mydccu.com on June 1, 2022.

Financials

February 28, 2021

Assets $1,587,493,934

Savings $1,420,760,376

Loans $945,703,802

Members 111,560

February 28, 2022

Assets $1,779,331,609

Savings $1,612,612,365

Loans $988,703,513

Members 117,128

Your Credit Union Leadership

Board of Directors

- Everett J. Campbell, Jr., Chairman

- Angela M. Simonetti, Vice Chairman

- Janet P. Mangun, Secretary

- Michael P. Blinn, Treasurer

- Marvin G. Copeland, Jr., Director

- Drew Ellen Gogian, Director

- David A. Kirby, Director

- Connie A. Fahey, Associate Director

- Christopher D. Terry, Associate Director

- Steve F. Elkins, President/CEO

Supervisory Committee

- Bruce F. Hamrick, Chairman

- Eugene F. Walker, Secretary

- Wesley B. Wampler, Member

- Jeff A. Miracle, Member

- Robin W. Ruleman, Member

- Marissa S. Helmick, Associate Member

Governance Committee

- Angela M. Simonetti, Committee Chair

- Drew Ellen Gogian, Board Director

- Marvin G. Copeland, Jr., Board Director

- Mary Louise Leake, Member

- David A. Passmore, Member