DCCU Routing # 251483311

How can DCCU help you today?

DCCU is committed to your financial wellbeing, and we want to keep you informed of concerning fraud trends and tactics happening in our community and across the world. Impersonators are using a range of tactics to obtain your personal and financial information, including website spoofs targeting local banks and credit unions. The goal is to trick you into giving away your banking or other personal information, such as banking usernames or passwords. They may also send out generic text messages that appear to be legitimate, but are complex schemes to defraud you. In today's electronic age, it's extremely important to be careful when doing business online or over the phone, and you should always stay informed about security issues and activities that could affect your economic future.

Smart Ways to Manage Your Privacy Online

Have you ever wondered why a free app would need access to your microphone and camera? Why does a game need access to all your contacts? How many apps are linked to your personal email address? If you are uncertain about the answers to any of these questions, now is a good time for a thorough review of the data you’re currently sharing.

It's important to be mindful of the trade-off between privacy and convenience. Before downloading a new app, opening an account online, or joining a new online community, carefully consider what you are willing to share in exchange. When in doubt, we suggest sharing less rather than more. Here are a few additional tips you can begin using today to help take control of your data:

- Make Informed Decisions

Before signing up for anything, think twice about how much of your information you are comfortable sharing with third parties. - Adjust Your Privacy Settings

Review and adjust your privacy settings for every app, account, or device you own. We suggest granting fewer permissions rather than more. - Protect Your Data

Create long (at least 12 characters), unique passwords for each account and device. Enable multi-factor authentication (MFA); and whenever possible, turn on automatic device, software, and browser updates.

Small changes to your privacy settings can make a big difference in keeping your information safe.

Ways to Protect Your DCCU Account

- Don't Respond to Scam Texts or Calls

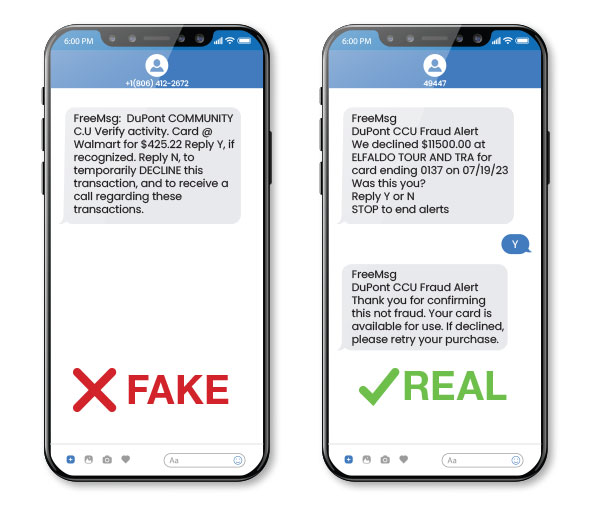

Genuine DCCU fraud alerts will come from short codes 29503 or 49447. If you don't recognize the number, don't answer the call. If it's important the caller will leave a message. - Verify the Caller

Don't trust the number displayed on your phone. Scammers can make CallerID appear however they want to. Contact us directly by calling 540-946-3200. - Know What We Will Never Request

DCCU will never text or call you to ask for your account number, password, Social Security number, mother's maiden name, or authorization (text/MFA) codes. - Avoid Pressure Tactics

We will never rush you or pressure you to provide information. Scammers often use scare tactics to make you act quickly. - No Third-Party Payment Services

We will never ask you to use other payment services like Cash App or Apple Cash, nor will we ask you to purchase gift cards, or use Crypto currency (Bitcoin, etc.)

Protect Yourself

- Online & Mobile

- Credit & Debit Card

- ATMs

- Identity Theft

To help our members better understand fraud, scams, and cyber security threats, the National Center Union Administration (NCUA) released a two-part video series on how to recognize, avoid, and report cyber fraud.

Helpful Tips

Credit and debit card fraud is the unauthorized use of card information to fraudulently make purchases and/or access funds. It can occur when cards are lost or stolen, in the midst of a data breech, or when account information is revealed and used in a scam.

Helpful Tips

In addition to the implementation of advanced physical and electronic monitoring, our ATM card readers have now been equipped with hardware which will further deter tampering. If the card reader or surrounding hardware is modified or damaged, the ATM will be immediately taken out of service. Additionally, pin-pad guards have been installed on all of our ATMs.

DCCU now utilizes chip technology to transmit data during transactions, rather than through the traditional magnetic strip. When your card is inserted in the ATM, the card reader will clamp down on your card, securing it in place during the transaction. Your card will be released once the transaction is complete.

We encourage your continued vigilance in helping to prevent ATM skimming in our community. When visiting an ATM or using any type of merchant card reader, we encourage you to take these steps to help protect yourself.

Helpful Tips

DCCU is dedicated to keeping our members' information safe and secure. Identity theft can happen to anyone, and occurs when someone falsely uses your name and personal information to get a loan, open a credit card or attempts information from your financial account. To ensure that you do not become a victim of identity theft, consider taking extra precautions

Helpful Tips

The Importance of Protecting Your Privacy Online

Four Ways to Safeguard Your Online Privacy

Three Benefits of Using a Mobile Wallet

Best Practices

- Never share your online banking username and password with anyone, including family members, employers, friends, or DCCU representatives. DCCU will never ask for this information.

- Avoid sharing your debit and credit card numbers with anyone, unless it is a legitimate purchase transaction you initiated.

- Be cautious of unsolicited calls, texts, and emails requesting personal or financial information. Impersonators may use scare tactics, like threatening to freeze your account or arrest you, in an attempt to prompt you into taking action.

- Be aware that impersonators may also pretend to be from your financial institution's fraud team or other departments to trick you into sharing your personal or financial information. Always verify the identity of the person you are speaking with, and when in doubt, disconnect the call and contact the person or organization directly.

- Use strong and unique passwords for your accounts and enable two-factor authentication whenever possible.

- Regularly monitor your accounts for any suspicious activity, such as unexpected transactions or changes to your personal information.

Be Aware of these Fraud Tactics

This section includes information about common scams and fraud tactics.

Social media quizzes are a seemingly fun and carefree way to pass time, but these quizzes may be designed to collect your sensitive information in an attempt to use it to gain your account information. Not all social media quizzes are data collection scams, but you should still proceed with caution before sharing any personal details online. For more information, please visit the Better Business Bureau’s website.

Social engineering is the act of tricking someone into disclosing a piece of valuable information such as a username, password, credit card number, or social security number. These attacks take advantage of human vulnerabilities such as emotions, trust, or habits in order to convince individuals to take action such as click a fraudulent link, visiting a malicious website, or sending unrecoverable funds to someone (often outside the country).

Phishing is the act of sending an email to a user falsely claiming to be an established legitimate enterprise in an attempt to scam the user into surrendering private information that may be used for fraud or identity theft. The email directs the user to visit a website where they are asked to update personal information such as: passwords, credit/debit card info, Social Security numbers, and the credit union/bank account numbers that the legitimate organization already has. The website, however, is a spoof and set up only to steal the user’s information.

Website spoofing happens when a scammer creates a fake website to look like legitimate businesses, organizations, and even financial insitutitions in an effort to trick users into compromising their personal information (such as banking usernames and passwords). As a reminder, DCCU will never request your online banking information.

Your safety is our priority. If you ever have doubts, don’t hesitate to contact us directly through our official channels. Stay vigilant and protect your information!

Scammers are increasingly targeting DCCU members with fake texts, emails, and phone calls. These fraudsters claim to work for DCCU and attempt to steal your money by requesting sensitive information such as account details and debit/credit card numbers. Just because someone claims to be from an organization, doesn’t mean they are. CallerID can be faked, even making their phone number appear as if it’s coming from DCCU (or other organizations) on your phone’s display screen.

It’s important to note, the scammer often knows nothing about you, including where you bank, until you reply to one of their fake messages. In most circumstances, they don’t even know if the phone number they are texting or calling is active until you respond. Financial institutions, government agencies and large retailers around the world are facing this same problem, and the best way to prevent and stop this kind of activity starts with you.

More Fraud Prevention Advice

Now that you're familiar with common fraud tactics, consider these additional steps to better protect your online privacy.

A credit report contains information about your credit history and the status of your credit accounts.

This information includes:

- How often you make your payments on time

- How much credit you have

- How much credit you have available

- How much credit you are using

- Whether a debt or bill collector is collecting on money you owe.

It can also contain public records such as liens, judgments, and bankruptcies that provide insight into your financial status and obligations. It is important to check your credit report regularly for accuracy. You can obtain a free credit report every 12 months from each of the three main credit reporting agencies – Equifax, Experian, and TransUnion – from a central website, www.annualcreditreport.com.

Automated Fraud Alerts allow us to contact members using electronic methods if we suspect a transaction may be fraud. Members will have the ability to immediately respond “Yes – this is fraud” or “No – this is not fraud” and the appropriate action will be taken.

How does it work?

- A text message will be sent to your mobile device if a suspicious transaction is identified.

- Simply reply to the text to confirm whether or not you recognize the transaction(s).

- If you reply that you do not recognize the transaction(s), you will receive a text respond back asking you to call Fraud Detection to report the transaction(s) and close the card. A block will be placed on your card to protect from further fraudulent transactions until you contact us.

- If you reply that you recognize the transaction(s), your card will remain available for use.

- If you do not reply to the text within 30 minutes, a pre-recorded call may be attempted at your mobile device and/or home number listed on your account.

- If you receive a pre-recorded call, please listen to the prompts provided to review and respond to the validity of each transaction that is presenting during the call.

- To reply to the pre-recorded message left on your phone, please call the number provided in the message to tell us whether or not you recognize the transaction(s).

How do I register for Fraud Text Alerts?

DCCU offers members the ability to enroll in advanced fraud alerts. Signing up is done on the Automated Fraud Alerts website. Click ‘View my Accounts’ from the navigation pane within Online Banking, and when the Account Dashboard loads, click ‘Enroll in Fraud Alerts’ in the Quick Links tile.

Traveling can be a hassle. We want to make it easier for you! To avoid inconvenience while traveling, notify us in advance of your plans to prevent unnecessary restrictions being placed on your card(s). Maximize your travel experience and help DCCU to better identify and protect against unauthorized transactions on your debit or credit card by adding a Travel Note before you leave. Add or change your Travel Note 24/7 through the Mobile App or Online Banking.

Place a Travel Note up to 14 days prior to traveling:

- In the Mobile App or Online Banking, select Travel Notice from the "More" or menu

- Select account being used for travel

- Enter the destination

- Select the start and end dates of your travel (maximum of 30 days)*

- Add your contact phone number and email address

Limit one Travel Note per card.

* If you are planning to travel for more than 30 days, please contact us.