DCCU Routing # 251483311

In This Issue

Member Matters is DCCU's quarterly newsletter that features credit union news, member stories, and more!

Expanding Our Reach through the DCCU Cares Foundation

DCCU has launched a foundation that builds on DCCU’s history of supporting both our members and community. The DCCU Cares Foundation is dedicated to expanding on the longstanding financial wellness and charitable efforts of DuPont Community Credit Union.

My Journey to Board Leadership

In 2023, Angie Simonetti was appointed Board Chair and has served on DCCU’s Board of Directors since 2017. She is passionate about the Credit Union’s mission to help improve the financial wellness of our members and the community.

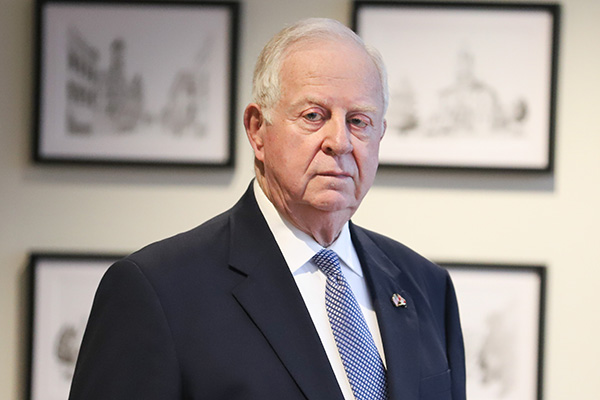

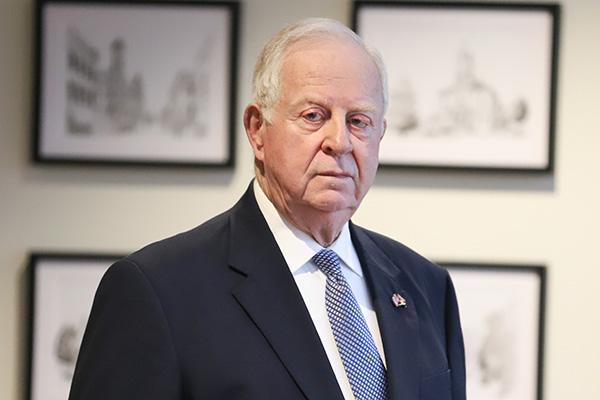

Campbell Retires After 21 Years of Board Service

DCCU recently announced Everett J. Campbell, Jr.’s retirement from DCCU’s Board of Directors after 21 years of service, 17 years as Board Chair. Here are a few highlights from his years of service.

Report from the Chair

DCCU experienced another positive year in 2023 as we demonstrated our continued commitment to the membership and our community.

Board of Directors Updates

Congratulations to Marvin G. Copeland, Jr. and Christopher D. Terry on their election by acclamation to DCCU’s Board of Directors, as announced at DCCU’s Annual Meeting on March 26, 2024.

Giving Back to Our Members and the Community

At DCCU, giving back to our members and community is a big part of who we are as a cooperative. Our 2023 Member and Community Impact Report highlights how we are helping to make a difference.

Employee Spotlight

25 Years of Service

Leslie Bretches

20 Years of Service

Lesley McLain

15 Years of Service

Kari Brown

Amy Neff

5 Years of Service

Devon Dean

Anne Huff

Brandon Murray

Rachael Ravenscroft

Promotions

Cheyenne Bridge - Software Development Manager

Vince Cash - Sales and Service Development Manager, AVP

Logan Deeds - Member Advisor

Jennifer Dull - Assistant Branch Manager

Kari-Lyn Henkel - Digital Marketing Specialist

Rachael Ravenscroft - Orgination Systems Analyst

Matt Shover - Project Manager I

I am pleased to announce that DCCU has launched a foundation that builds on DCCU’s history of supporting both our members and community. The DCCU Cares Foundation is dedicated to expanding on the longstanding financial wellness and charitable efforts of DuPont Community Credit Union.

As a credit union, we have embraced the opportunity to be at the forefront of financial wellness. By establishing a foundation that has strategic giving programs that align with our mission, we can make an even greater impact on financial health and the community. This new entity has a vision to provide DCCU members, employees, and the community at large with solutions to improve financial wellness, promote education, drive engagement, and grow community partnerships.

These are the areas of focus for the DCCU Cares Foundation:

Financial Wellness

Promote and provide financial education and resources to empower individual and family sustainability.

Promote Education

Offer post-secondary scholarships along with community based financial education to schools and other organizations that will support financial wellness initiatives that aid in building a financially responsible and better prepared workforce.

Member, Employee and Community Engagement

Connect our members, employees, neighbors, businesses and community organizations to charitable giving programs, events, and volunteer opportunities that impact our outreach to the entire community.

Community Partnerships

Foster transformative community projects that contribute to a higher quality of life, financial stability, a more competitive economic region, and relief in times of need for our members and neighbors.

While still in the early stages, we are excited about the DCCU Cares Foundation and our plans to build meaningful relationships through thoughtful, strategic philanthropy as we aim to advance our community’s financial health in inspiring ways both today and for many years to come. More information will be shared in the coming months about how you can engage with the DCCU Cares Foundation. In the meantime, please visit the Foundation’s webpage for more detailed information and the latest updates.

Angie Simonetti is a native of the Shenandoah Valley and has served on DCCU’s Board of Directors since 2017. She is passionate about the Credit Union’s mission to help improve the financial wellness of our members and the community. In 2023, she was appointed Board Chair, however Angie’s relationship with DCCU started at an early age.

“I have been a DCCU member since I was in middle school, when I opened my first savings account,” said Angie. “Even then, I appreciated how the Credit Union provided education around financial wellness, making the most of your accounts and how to best utilize the resources available to members. The knowledge they shared helped set me on the right path for long-term financial success.”

During her senior year of high school, Angie started working for DCCU as a Teller at the Verona Member Center, and she continued working at the Service Center and Kaylor Drive locations after she enrolled at James Madison University (JMU). “I spent my entire college career working solely for DCCU and it was a fantastic experience,” said Angie. “Working at DCCU was such a unique experience because I was able to see so many aspects of business. Without a doubt, the Credit Union laid the foundation for my understanding of business and greatly influenced my career path.”

Equipped with a degree in Communication Studies and Public Relations from JMU along with the business acumen and problem-solving skills she learned during her time at DCCU, Angie entered the workforce. As she journeyed through her career over the next several years, Angie never forgot about her experience at DCCU and her desire to continue serving the Credit Union and its members. “When I was a college student working in the Service Center, I had aspirations of being a member of DCCU’s Board of Directors one day,” Angie said. “From becoming a member at a young age, to working there as a young adult, then continuing to see the great work DCCU was doing – it instilled a passion for improving the financial wellness of our members and the community. It made me want to come back and serve.”

In 2016 Angie applied and joined the Board as an Associate Director in 2017. Since then, Angie’s role as a volunteer has continued to expand, becoming a Board Director in 2018 and serving on the Asset Liability Management (ALM), Governance, and Personnel Committees.

2023 brought historic changes to DCCU’s Board of Directors when Angie was appointed Board Chair following Everett Campbell, Jr. who served on the Board for 21 years, 17 as Board Chair. “The knowledge that Everett brought to the Board Chair role is immeasurable,” Angie said. “He was happy to share historical Credit Union knowledge, as well as insights and advice from his experience. I appreciate the way he instilled his confidence in me – it meant a great deal.”

As Angie continues her tenure as Board Chair, there are some key values from Everett that she keeps top of mind. “Our membership is number one. We are here to look out for their best interests,” said Angie. “That is followed closely by supporting our staff, who are key to our success as a cooperative because they are passionate about our mission, members, and community.”

Looking ahead, Angie is excited about what’s on the horizon for DCCU and encourages anyone who is interested in serving on the Board to apply. “We don’t expect Board volunteers to be an expert in credit unions or finances. Truly the most important thing is that they are passionate about the work of DCCU and the community,” Angie said. “We are representing over 118,000 members and serve as their voice while ensuring that the Credit Union continues to be good stewards of our members’ resources. Board volunteers choose to serve because it’s incredibly rewarding to see firsthand the work that DCCU is doing for our members and the community.”

Report from the Chair

Angie Simonetti, Chair, Board of Directors

DCCU experienced another positive year in 2023 as we demonstrated our continued commitment to the membership and our community.

Highlights from 2023:

- We funded $75.5 Million in real estate loans in 2023, helping 358 members purchase or refinance their homes, including 107 first-time homebuyers. We remain committed to supporting the mortgage needs of our members.

- Additionally, we served 7,693 members as we funded $79.6 Million in auto loans (3,780), $13.8 Million in credit card lending (3,400), and $34.4 Million in home equity loans (513); and $15.9 Million in member business loans (72).

- DCCU launched an innovative new Rebate Program where members can earn a 10% rebate on their interest paid on a personal credit card, auto, home equity, or personal loans. The rebate is deposited into their DCCU savings account monthly.

- Video Banking was introduced at three drive-up ATM locations – Grottoes, West Staunton, and Windward Pointe. In addition to standard ATM functionality, these ATMs now offer members the opportunity to speak with a DCCU representative by video to ask questions or request assistance.

- DCCU installed self-service Coin Counters at six Member Centers. This free service allows members to easily deposit loose change into their DCCU account or receive it in cash.

- DCCU had another strong year supporting the Blue Ridge Area Food Bank in 2023. Through our Spring and Fall Shred Days, “Shop and Give” credit card campaign, JMU Hometown Home Runs sponsorship, and employee fundraisers, DCCU donated $38,903 and 9,535 pounds of food to the Food Bank, which helped them provide over 163,500 meals for families in need.

- DCCU continues to support the United Way and the services they provide to our community. Through Corporate Charity and employee donations, DCCU divided a donation of $22,125 to the United Way of Northern Shenandoah Valley, the United Way of Harrisonburg, Rockingham, the United Way of Staunton, Augusta, Waynesboro, and the United Way of Lexington, Rockbridge, Buena Vista.

- DCCU donated $21,000 to Habitat for Humanity affiliates in our community. Various fundraisers were held throughout the year to support the work they do throughout the Valley.

- In October, DCCU employees joined together in support of DCCU Cares Month, a corporate volunteering initiative where employees spent 551 hours supporting local organizations throughout our field of membership.

These highlights reflect some of the ways we deliver value to our members and help make a difference in our community. We look forward to serving you in 2024. On behalf of the Board of Directors and the staff of DuPont Community Credit Union, we appreciate your membership and continued support of our financial cooperative.

Campbell Retires After 21 Years of Board Service

DCCU recently announced Everett J. Campbell, Jr.’s retirement from DCCU’s Board of Directors after 21 years of service, 17 years as Board Chair. During his tenure, he also served on the Asset Liability Management (ALM), Personnel, Governance, and Building Task Force Committees.

“Everett has ensured that the Credit Union and the Board are in a strong position,” said Angie Simonetti, Board Chair. “He has done amazing work to ensure the soundness of the Credit Union.” Under Campbell’s leadership, DCCU demonstrated stability and progress. Here are a few highlights from his years of service from 2003 – 2024:

- The Credit Union’s membership rose from 43,076 to 118,067.

- Our assets increased from $438,208,445 to $1,814,161,514.

- The number of DCCU Member Centers grew from 7 to 14.

- Our number of employees grew from 165 to 375.

“I am grateful to Everett for his 21 years of dedicated service to DCCU and his steadfast leadership of our Board for 17 years. He has been a strong advocate of the credit union movement, relentlessly advocating for our members,” said Steve F. Elkins, DCCU President and CEO.

Board of Directors Updates

Congratulations to Marvin G. Copeland, Jr. and Christopher D. Terry on their election by acclamation to DCCU’s Board of Directors, as announced at DCCU’s Annual Meeting on March 26, 2024. Both will serve a 3-year term.

Marvin G. Copeland, Jr.

Christopher D. Terry

Each year, the Governance Committee is tasked with seeking member volunteers for possible openings on the DCCU Board of Directors, Supervisory Committee, and Governance Committee. Nominations will be accepted June 1-30, 2024 for positions opening in 2025.

There will be three 3-year terms expiring on the Board in 2025 for Michael P. Blinn, Janet P. Mangun, and Angie M. Simonetti. Details about volunteer openings and the nomination process will be available at mydccu.com by May 31, 2024.

Giving Back to Our Members and the Community

At DCCU, giving back to our members and community is a big part of who we are as a cooperative. Because our members come first, we are committed to offering competitive products, services, and rates that help families and local businesses meet their needs. Here are some of the ways we gave back to our members in 2023:

2023 Member Giveback

$28.9 Million

Rewards 16%

Cash and rewards points to members for using their credit and/or debit cards – $4.7MM

Refunds 5%

A return or repayment of a fee, such as Overdraft Protection or a Foreign ATM fee – $1.5MM

Promotions 4%

Special member offers like loan interest rebates – $976M

Dividends 75%

A portion of our earnings paid back to our members based on deposit balances – $21.7MM

Giving Back doesn’t stop with our members. We also care about the communities we serve and do our part to help make our community better through financial education, scholarships, volunteerism, sponsorships and donations.

Our 2023 Member and Community Impact Report highlights how we are helping to make a difference. Visit mydccu.com/publications to view the report.

Financials

February 28, 2023

Assets $1,815,884,227

Savings $1,668,428,346

Loans $1,130,654,328

Members 116,149

February 29, 2024

Assets $1,814,161,514

Savings $1,652,684,302

Loans $1,145,939,075

Members 118,067

Your Credit Union Leadership

Board of Directors

- Angela M. Simonetti, Chair

- Everett J. Campbell, Jr., Vice Chair

- Drew Ellen Gogian, Secretary

- Michael P. Blinn, Treasurer

- Marvin G. Copeland, Jr., Director

- David A. Kirby, Director

- Janet P. Mangun, Director

- Christopher D. Terry, Associate Director

- Steve F. Elkins, President/CEO

Supervisory Committee

- Bruce F. Hamrick, Chair

- Eugene F. Walker, Secretary

- Wesley B. Wampler, Member

- Robin W. Ruleman, Member

- Marissa S. Helmick, Member

- Pamela B. Adams, Associate Member

Governance Committee

- Marvin G. Copeland, Jr., Board Director, Committee Chair

- Drew Ellen Gogian, Board Director

- Everett J. Campbell, Jr., Board Director

- Mary Louise Yates, Member

- David D. Passmore, Member