DCCU Routing # 251483311

In today's market, obtaining a mortgage with a low interest rate, while meeting other needs can be challenging. With the different mortgage options available, it's important to carefully consider the benefits of each type to find the right fit. People often choose more traditional mortgage options, such as a fixed-rate mortgage, but another possibility is an adjustable-rate mortgage—ARM for short. An ARM can provide flexibility and suit a variety of home buyer needs.

How an Adjustable-Rate Mortgage Works

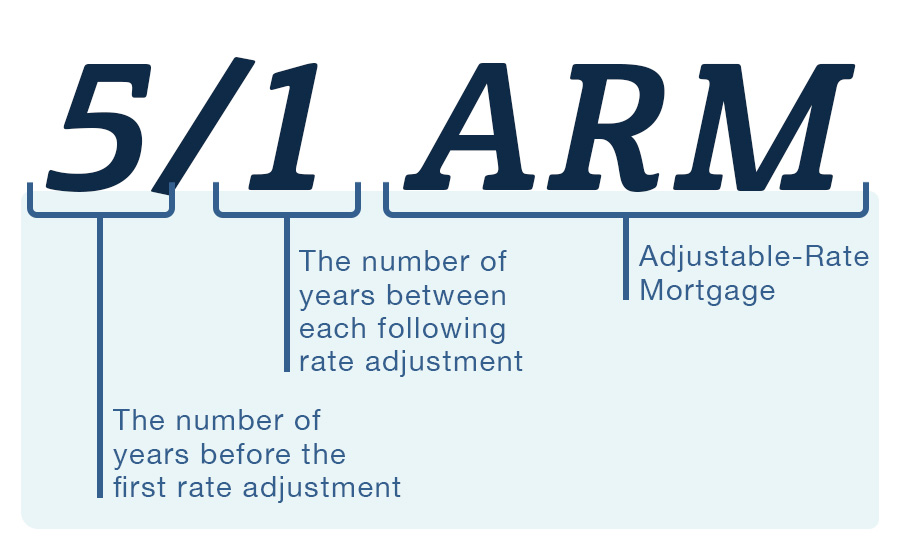

An ARM is a loan with a fixed rate for a certain amount of time, then the rate adjusts at regular intervals after the initial fixed period. Two of the most common ARMs are a 3/1 or 5/1 ARM.

- A 3/1 ARM will have a fixed interest rate for three years, and will then be adjusted yearly after that

- In a 5/1 ARM, your interest rate will be fixed for five years, and then adjust yearly once a year after this initial period

- DCCU offers a 5/5 ARM with a fixed rate for five years and rate changes at five year intervals

Although the interest rate isn't as predictable as it is with a fixed-rate mortgage, there are many benefits of an ARM that can outweigh a few homebuyer risks. For example, with an ARM, homeowners can enjoy lower interest rates upfront, potential rate decreases, and more flexibility in the loan terms. If any of these options sounds interesting to you, an ARM could be the right fit for your home buying needs. Let's explore these benefits further.

Benefit #1: Lower interest rates early in the loan term

With a traditional fixed-rate mortgage, the risk of rate increases falls to the lender, who will have to absorb the interest rate changes. Since interest rates fluctuate for the buyer with an ARM, many mortgage lenders will often lower initial rates to offset the cost of potential rate increases in the future. With a lower interest rate you could reduce your mortgage principal more quickly while enjoying a lower monthly payment.

Benefit #2: If interest rates go down, so does your payment

After the fixed period of your loan ends, your mortgage rate will change based on the market and other economic factors. This means that if market rates go down, your interest rate will likely decrease as well—potentially lowering your monthly payment amount!

Alternatively, if rates increase, your interest rate and mortgage payment will also increase. Since future rates can be unpredictable, keep in mind that ARMs have caps on how much your interest rate or monthly payment can increase, depending on your lender. Refinancing with a lower interest rate is also an option if your ARM rate is higher than you'd like.

Benefit #3: Up to 100% financing may be available

Some mortgage lenders, like DCCU, offer full financing to qualified borrowers with an ARM, as long as the loan is insured by Private Mortgage Insurance (PMI). PMI is often required for home buyers who provide less than a 20% down payment on a home, and is a safeguard for the lender in the event that the homeowner is unable to repay their mortgage.

Benefit #4: Flexibility

Adjustable-rate mortgages with shorter fixed-rate periods are worth considering for homeowners who plan to move or refinance their homes in the near future. The shorter the ARM's fixed period (the first number in a 3/1 or 5/1 ARM), the lower your interest rate may be. Homeowners can take advantage of the low initial rate, then avoid potential increases if they refinance before the adjustment period begins.

Each mortgage lender will offer different ARMs with various fixed-rate and adjustment periods. For instance, DCCU offers three types of ARMs to meet your financial needs: 3/1, 5/1 and a new 5/5 ARM. What makes the 5/5 ARM unique is that it has a fixed period of five years, and then the interest rate adjusts every five years after that—meaning it could be suitable for both short- and long-term living arrangements.

Overall, financing your home with an adjustable-rate mortgage (ARM) can provide you with the benefit of lower payments and more flexibility. It can be great for home buyers with less money for a down payment, regardless of how long they plan to stay in the home. If you're interested in comparing your fixed- and adjustable-rate mortgage options, find out with our Fixed- or Adjustable-Rate Mortgage Calculator to see which may be the best fit for you.

DCCU offers local, personalized service to home buyers across the Shenandoah Valley. If you're interested in starting your home buying journey with an adjustable-rate mortgage, contact one of our local Mortgage Advisors today!

This article is for informational purposes only and not intended to provide specific advice or recommendations for individual.

Mortgage Resources

Fixed or Adjustable Rate Mortgage Calculator