DCCU Routing # 251483311

In This Issue

Member Matters is DCCU's quarterly newsletter that features credit union news, member stories, and more!

Navigating Economic Uncertainty

We've been in this current season of uncertainty for a while now and remain committed to keeping our members' needs at the forefront as we provide sound advice and competitive products to help you navigate the inevitable shifts in the financial landscape.

A Partner in Business and Community

Bobby Collier had always wanted to own his own business. After a lengthy career in banking, a unique opportunity presented itself. After much thought and consideration, he and his wife purchased micah's coffee in 2012 and embarked on their new entrepreneurial journey.

Giving Back to Our Members and the Community

Giving back to our members and community is a big part of who we are as a cooperative. Our 2022 Member and Community Impact Report highlights how DCCU partnered with our members, employees, and local organizations to help make the Shenandoah Valley a better place.

Chairman's Report

From Everett J. Campbell, Chair, Board of Directors

Board of Directors Election Results

The results are in for DCCU's 2023 Board election

Spring Shred Days Coming Soon

Help protect your identity and support the Blue Ridge Area Food Bank.

Employee Spotlight

20 Years of Service

Ruth Punswick

Jennifer Wheeler

5 Years of Service

James Allen

Andi Parr

Matt Shover

Joe Wingfield

Promotions

Amber Coffey - Retail Operations Manager

Lindsey Coffey - Sr. Marketing Project Coordinator

Amber Coffman - Member Advisor

Jackie Combs - QA Specialist

Dan Cornish - Jr. Systems Administrator

Anna Dillard - Sr. Member Advisor

Heather Farrar - Consumer Credit AVP

Mike Ferguson - Controller AVP

Melody Godbey - Human Resources AVP

Kari-Lyn Henkel - Lead Digital Designer

Penny Johnson - Payments AVP

Bryce Landram - HR Coordinator

Heather May - Staff Development Operations AVP

Kim McClamroch - Mortgage Operations AVP

Rena McCormick - Sr. Commercial Underwriter

Cindy Nuckoles - Information Technology SVP

Stephanie Painter - BSA/Compliance AVP

Eugene Rankin - Commercial Credit AVP

Celeste Rodriguez - Member Advisor

Carol Shaffer - Sr. Solutions Officer

Taylor Shover - Sr. Member Representative

Emily Stagner - Staff Accountant

David Whitehill - BI & Data Analytics AVP

DCCU was founded in 1959, and through the years we have experienced several periods of economic uncertainty - the energy crisis in the 70s, the savings and loan crisis in the 80s and 90s, the dot-com collapse and Great Recession in the 2000s, and most recently the COVID-19 pandemic. Although each situation presented unique circumstances, DCCU's focus on supporting the financial health of our members was constant. Today, we remain committed to keeping our members' needs at the forefront as we provide sound advice and competitive products to help you navigate the inevitable shifts in the financial landscape.

With the economy top of mind right now, particularly rising interest rates and inflation, we understand the challenges it may present. DCCU is here to support you and help you with any questions you may have or situations you may face. If there is anything you would like counsel on, we want to talk with you. Our staff members are trained to listen and then use the information to offer recommendations and solutions for your individual needs. Most financial institutions offer products and services to meet your banking needs, but what makes DCCU unique is how we serve our members, even as it pertains to the range of products we offer. We work to anticipate needs and look for ways to enhance our products to benefit our members. One example is our deposit products.

Foundational banking products, like checking and savings accounts, provide tools to manage spending while also setting money aside for future needs. Our Grow Checking account pays a dividend based on how you use your debit card and we recently raised our already competitive rates to help our members earn even more. We have also been adjusting rates on some of our certificate products. Raising certificate rates helps you earn greater returns on your savings and help build your savings in a prudent way with minimal risk. Both deposit options help you earn more on your checking and savings and help your dollars stretch a little further.

We've been in this current season of uncertainty for a while now and we understand the ways it may be impacting your financial lives. We are here to support you and help you with any obstacles, as well as opportunities you encounter. DCCU cares about your financial future and we are here to help you manage your broad range of financial needs. As always, we thank you for your continued support of our cooperative.

Bobby Collier had always wanted to own his own business. After a lengthy career in banking, a unique opportunity presented itself. "My pastor, Josh Akin, founded micah's coffee in Waynesboro in 2004, and when he was ready to sell, he approached my wife Megan and I about purchasing it," Bobby said. "Josh shared the prospectus and right away we were intrigued." After learning more about the concept, and much thought and consideration, they went for it. The Colliers purchased micah's coffee in 2012 and embarked on their new entrepreneurial journey.

The first few years involved hands-on training and lots of learning. "I poured into the business. Although I had an amazing team who showed me where everything is, and how to make the beverages, I needed more," Bobby said. "So I put myself through coffee school to broaden my coffee knowledge, and then technician school to learn how to fix the machines. I believed in what we were doing, so I wanted to give it my best." And it paid off. Just a few short years after the transition, micah's started to gain traction and business began to take off with expansion to Stuarts Draft in 2015 and Ruckersville in 2018.

As micah's continued to grow, so did their need for a trusted banking partner. "When we purchased micah's, we started our accounts with DCCU and it was primarily a deposit relationship," Bobby said. "And as we grew, so did our banking relationship." Opening additional locations resulted in larger needs for things like equipment and small renovations, which called for banking products like credit cards and lines of credit.

Presently, the Colliers are working with DCCU on two exciting ventures - replacing the Waynesboro location that was recently damaged in an accident, and opening a fourth location/headquarters in Staunton. This is when having an established banking relationship is important.

"We now have a DCCU Commercial Lender, Nick Martino, who has become our partner in these renovations, which has been very helpful, especially during a challenging economy," Bobby said. "We are learning and growing in waters that are new to us and Nick is helping us navigate through."

Slated to open in Spring 2023, the Staunton micah's will be located at 704 Richmond Avenue. "This location will also serve as our headquarters and provide space to not only serve great coffee, but where we can hold staff meetings, conduct training, and store inventory," Bobby said. "We are really excited to bring the micah's experience to the Staunton area. We are now in the final stages of construction and completing the finishing touches."

DCCU and micah's coffee share two important attributes - commitment to serving others and supporting the community. "DCCU is my local community bank. Everyone knows who I am when I walk in, and I love that," Bobby said. "In the same way, micah's is built to serve the community and build relationships with our customers. You can get coffee anywhere, but we're all about conversations, relationships, and supporting the community that supports us. We also happen to have really good coffee."

The Colliers are excited about the future of micah's coffee as they continue to deepen their roots in the Valley; and DCCU is here to support their banking needs along the way. "This community is lucky to have a credit union like DCCU that wants to build relationships and be a part of the community," Bobby said. "That's what separates DCCU from other financial institutions and micah's from other coffee shops - it's about relationships and quality. We both do it differently."

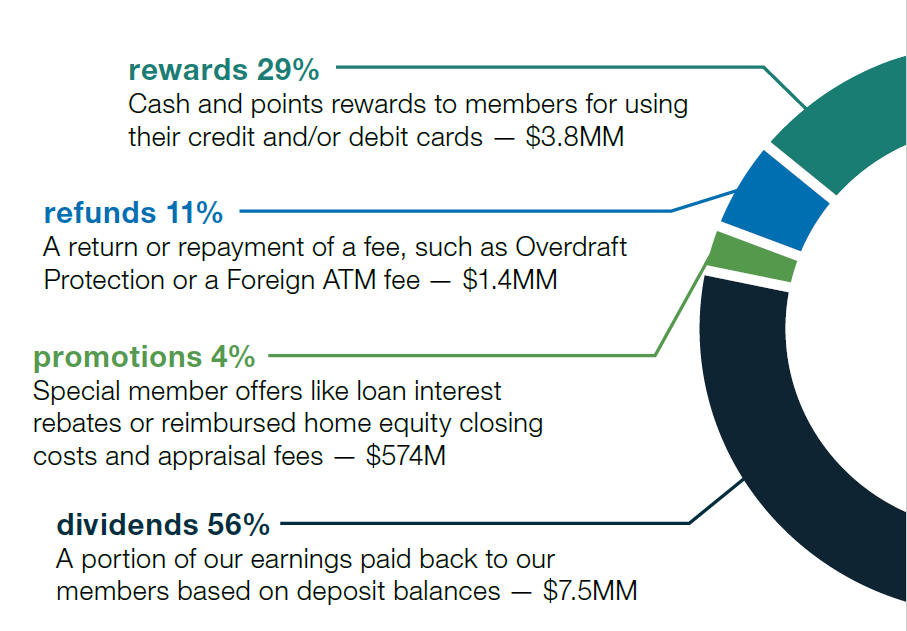

Giving Back to Our Members and the Community

At DCCU, giving back to our members and community is a big part of who we are as a cooperative. Because our members come first, we are committed to offering competitive rates that help families and local businesses meet their needs. Here are some of the ways we gave back to our members in 2022:

2022 Member Giveback

$13.3 Million

Giving back doesn't stop with our members. We care deeply about the communities we serve and do our part to help make our community better through financial education, scholarships, volunteerism, sponsorships, and donations.

Our 2022 Member and Community Impact Report highlights how DCCU partnered with our members, employees, and local organizations to help make the Shenandoah Valley a better place.

Topics include:

- Member Giveback

- Campaigns Making a Big Impact

- Investing In Technology to Serve Our Members Better

- Giving Back to the Community

- Commitment to Education and Financial Wellness

- Supporting Our Community Partners

- And more!

Chairman's Report

From Everett J. Campbell, Chair, Board of Directors

DuPont Community Credit Union (DCCU) experienced another positive year in 2022 as we demonstrated our continued commitment to the membership and our community.

Highlights from 2022:

- We funded $140.7 Million in real estate loans in 2022, helping 663 members purchase or refinance their homes, including 174 first-time homebuyers. We remain committed to supporting the mortgage needs of our members.

- Additionally, we served 9,888 members as we funded $106 Million in auto loans (4,940), $17.0 Million in credit cards (3,788), $76.3 Million in home equity loans (1,042), and $80.7 Million in member business loans (118).

- DCCU launched a new and improved website that provides a consultative online experience and complements the personal service our members are accustomed to receiving when interacting with us in our branches or by phone.

- Windward Pointe, DCCU’s 14th Member Center, opened in the Summer of 2022. Located in Fishersville, this branch introduced Personal Teller Machines (PTMs) as a new service. In addition to having an experienced retail team for consultative requests such as new accounts or loans, PTMs operate as a traditional ATM for routine transactions with added video capabilities that allow members to speak with a DCCU representative by video.

- DCCU launched an enhanced Business Online Banking service to help our business members manage their finances more efficiently.

- DCCU donated $32,125 to Habitat for Humanity affiliates in our community. Various campaigns and fundraisers were held throughout the year, including our Corporate Charity and our DCCU Cares Virtual 5K/10K for employees.

- DCCU had another strong year supporting the Blue Ridge Area Food Bank in 2022. Through our Spring and Fall Shred Days, “Shop and Give” credit card campaign, and employee fundraisers, DCCU donated $29,699 and 7,448 pounds of food to the Food Bank, which helped them provide approximately 125,000 meals for families in need.

- DCCU continues to support the United Way and the services they provide to our community. Through Corporate Charity and employee donations and pledges, DCCU divided a donation of $21,500 to the United Way of Northern Shenandoah Valley, the United Way of Harrisonburg, Rockingham, the United Way of Staunton, Augusta, Waynesboro, and the United Way of Lexington, Rockbridge, Buena Vista.

- The Virginia Credit Union League selected DCCU as the winner of the 2022 Louise Herring Philosophy In Action Award in the over $1 Billion asset size category. We received first place for our 2021 “Make a Difference When You DIY” campaign, which encouraged DCCU credit card holders to use their DCCU credit card for DIY purchases and a portion of the dollars spent was donated to local Habitat for Humanity affiliates.

These highlights reflect some of the ways we deliver value to our members and help make a difference in our community. We are encouraged about 2023 and excited for the many years ahead. On behalf of the Board of Directors and the staff of DuPont Community Credit Union, we appreciate your membership and continued support of our financial cooperative.

Drew Ellen Gogian

David A. Kirby

2023 Board of Directors Election Results Announced

Congratulations to Drew Ellen Gogian and David A. Kirby on their election to DCCU's Board of Directors, as announced at DCCU's Virtual Annual Meeting on March 28, 2023. Each will serve a three-year term.

Each year, the Governance Committee is tasked with seeking member volunteers for possible openings on the DCCU Board of Directors, Supervisory Committee, and Governance Committee. Nominations will be accepted June 1 - 30, 2023 for positions opening in 2024.

There will be two three-year terms expiring on the Board in 2024 for Everett J. Campbell, Jr. and Marvin G. Copeland, Jr. Details about volunteer openings and the nomination process will be available at mydccu.com on June 1, 2023.

Financials

February 28, 2022

Assets $1,779,331,609

Savings $1,612,612,365

Loans $988,703,513

Members 117,128

February 28, 2023

Assets $1,815,884,227

Savings $1,668,428,346

Loans $1,130,654,328

Members 116,149

Your Credit Union Leadership

Board of Directors

- Everett J. Campbell, Jr., Chair

- Angela M. Simonetti, Vice Chair

- Janet P. Mangun, Secretary

- Michael P. Blinn, Treasurer

- Marvin G. Copeland, Jr., Director

- Drew Ellen Gogian, Director

- David A. Kirby, Director

- Connie A. Fahey, Associate Director

- Christopher D. Terry, Associate Director

- Steve F. Elkins, President/CEO

Supervisory Committee

- Bruce F. Hamrick, Chair

- Eugene F. Walker, Secretary

- Wesley B. Wampler, Member

- Robin W. Ruleman, Member

- Marissa S. Helmick, Member

Governance Committee

- Angela M. Simonetti, Committee Chair

- Drew Ellen Gogian, Board Director

- Marvin G. Copeland, Jr., Board Director

- Mary Louise Leake, Member

- David A. Passmore, Member